Auto Insurance Quote Insurance Funender Qph Quoracdn Quora

Auto Insurance Quotes are essential for drivers looking to protect their vehicles and finances in case of accidents or damages. They provide potential policyholders with a way to compare different insurance policies and premiums offered by various insurance companies. Securing the right insurance policy can be a daunting task, but understanding the purpose and mechanics of auto insurance quotes can clarify the process.

When seeking an auto insurance quote, it is crucial to recognize the various elements that come into play:

- Coverage Types: Auto insurance typically offers multiple coverage options, including liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist coverage.

- Premiums: The cost you pay for your insurance policy is called the premium. It can vary significantly based on coverage levels, the type of vehicle, driving history, and a variety of other factors.

- Deductibles: This is the amount you agree to pay out of pocket before your insurer starts covering the claims. A higher deductible usually results in a lower premium and vice-versa.

- Discounts: Many insurers offer discounts based on various factors, such as safe driving history, bundling policies, or having safety features in your vehicle.

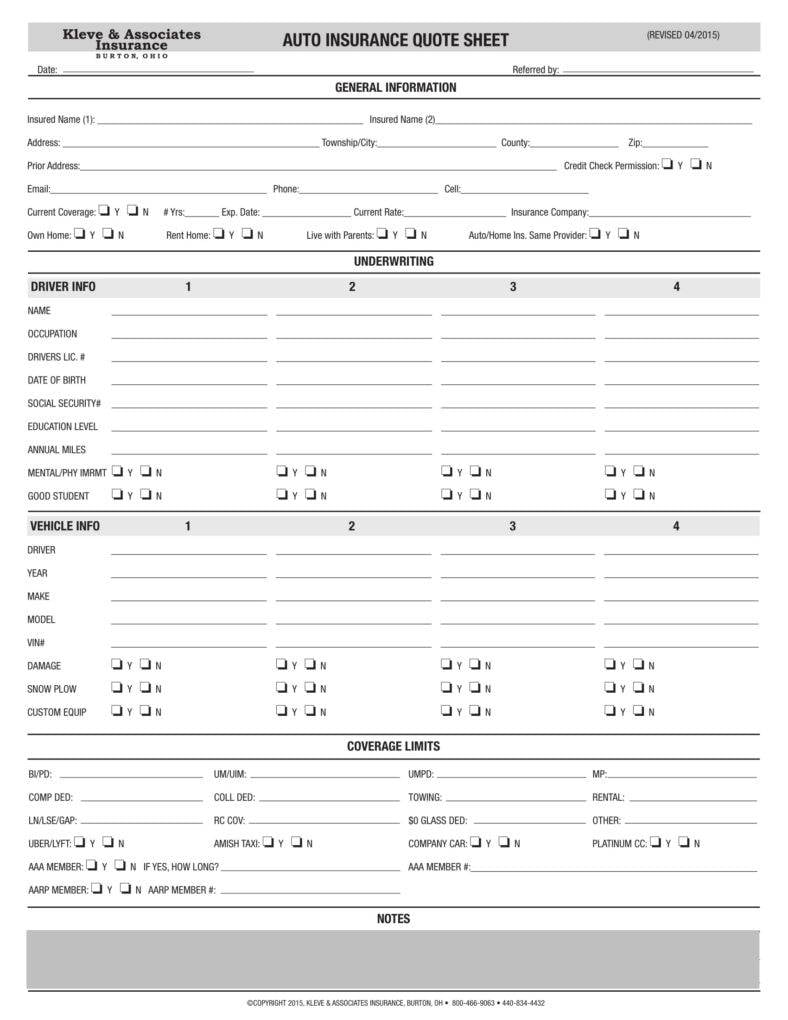

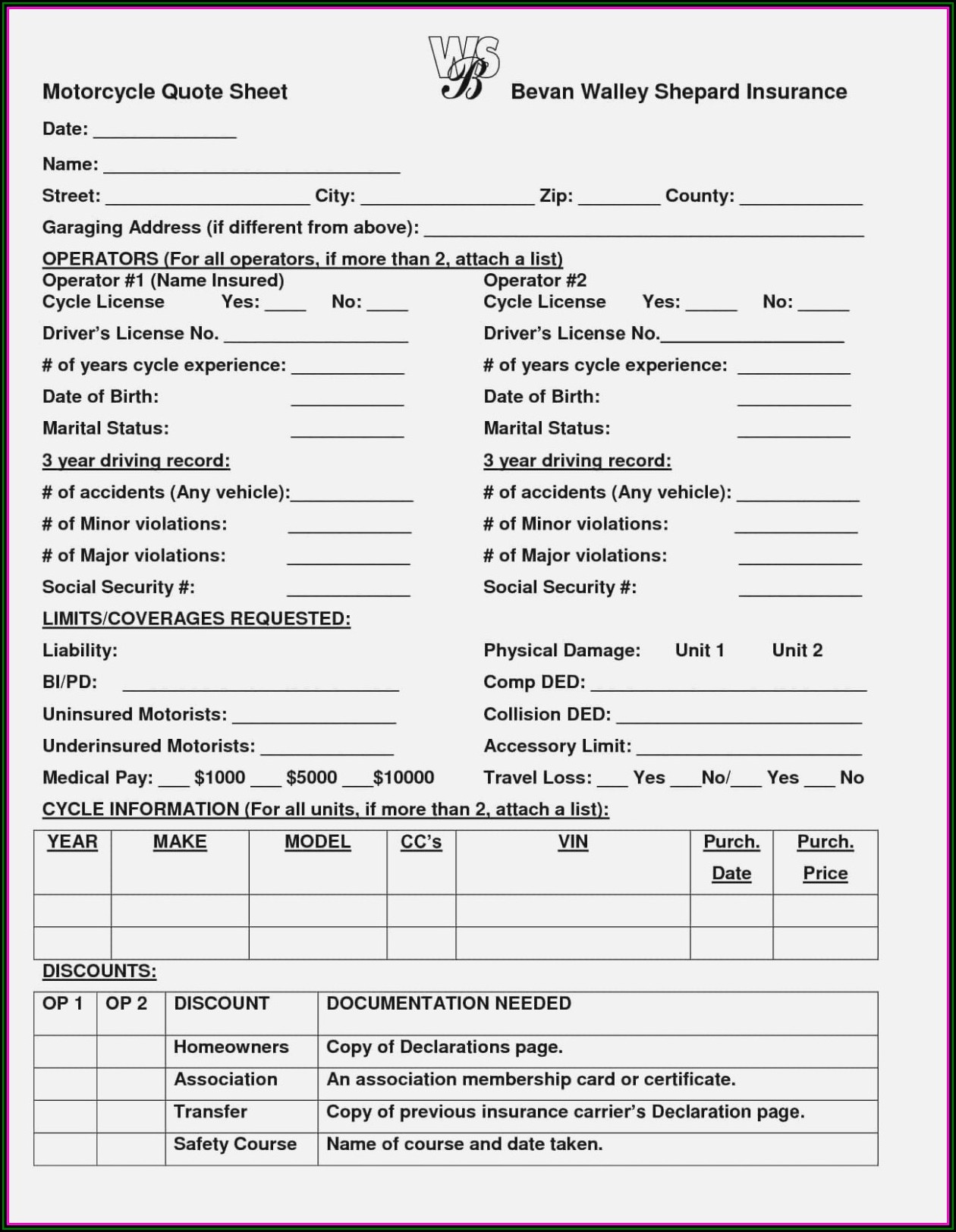

Obtaining an auto insurance quote usually involves providing personal information to the insurance company or through insurance comparison websites. The following steps may help streamline the process:

- Gather Personal Information: You'll typically need to provide details such as your name, address, date of birth, and driver's license number.

- Vehicle Information: Insurers will require information about the vehicle you are insuring, including the make, model, year, vehicle identification number (VIN), and usage details.

- Driving History: This includes any previous accidents, claims, and traffic violations, which can significantly impact your premium.

- Desired Coverage: Clearly outline the type and level of coverage you require to receive accurate quotes.

Once all necessary information is submitted, the insurance company can provide a quote reflecting the expected premiums for the desired coverage levels. Online insurance quote comparison tools can also assist in evaluating multiple offers from different providers quickly.

Auto Insurance Quotes and Their Importance

Auto insurance quotes are important for several reasons:

- Financial Protection: In the event of an accident or damage, auto insurance helps cover the costs, safeguarding your financial stability.

- Legal Requirements: Most states require drivers to carry a minimum amount of auto insurance.

- Peace of Mind: Knowing you have coverage can reduce the stress and worry associated with driving.

- Customization: Quotes allow you to tailor your insurance policy to meet your specific needs and budget.

How to Analyze and Compare Auto Insurance Quotes

When you receive auto insurance quotes, it’s essential to analyze and compare them properly:

- Evaluate Coverage: Ensure that you are comparing quotes based on similar coverage levels to get a clear perspective on costs.

- Look for Exclusions: Pay attention to what is not covered by the policy. Understanding exclusions can prevent unpleasant surprises later.

- Consider Customer Service: Research each company's customer service reputation as this can impact your experience when filing a claim.

- Review Financial Stability: Check the financial ratings of the insurers to ensure they can pay claims when needed.

Additional Factors Influencing Auto Insurance Premiums

Several factors influence auto insurance premiums, including:

- Age and Gender: Younger drivers or male drivers typically face higher premiums due to statistical driving risks.

- Credit Score: Insurers often use credit scores to predict risk; a poor credit score can significantly raise premiums.

- Location: Areas with high incident rates for theft or accidents can lead to higher premiums.

- Vehicle Type: Luxury or sports cars generally incur higher premiums due to their replacement costs.

Finding the Right Auto Insurance Policy

To find the right auto insurance policy, consider the following:

- Assess Your Needs: Identify what coverage is most important for your specific situation and vehicle.

- Obtain Multiple Quotes: Don’t settle for the first quote; comparing multiple quotes can save you money.

- Read Customer Reviews: Take into account reviews and testimonials from other customers regarding their experiences with the insurer.

- Consult an Insurance Agent: Professional financial advice may help in navigating the nuances of insurance policies.

The Process of Applying for Auto Insurance

Applying for an auto insurance quote usually involves the following steps:

- Online Application: Most companies allow you to apply for a quote online for convenience.

- Phone Quotes: You can also obtain quotes by contacting insurance agents via phone, who can guide you through the process.

- In-Person Meetings: For a more detailed discussion about your options, visiting an insurance agency may be beneficial.

Understanding Auto Insurance Terms

Before you finalize your insurance policy, understanding common auto insurance terms can help you make informed decisions:

- Liability Coverage: This covers damages to others’ property or medical costs if you are at fault in an accident.

- Collision Coverage: This pays for damage to your vehicle from accidents, regardless of fault.

- Comprehensive Coverage: This protects against damages to your vehicle from non-collision incidents, like theft or natural disasters.

- Uninsured Motorist Coverage: This protects you in the event of an accident with a driver who lacks insurance.

By understanding these concepts, you will be better equipped to interpret quotes and select a policy that suits your needs.

1. What factors should I consider when obtaining an Auto Insurance Quote?

When obtaining an auto insurance quote, consider factors such as the type of coverage you need, your driving history, the make and model of your vehicle, your location, and any possible discounts that may apply to you. Each element directly influences your premium and the overall effectiveness of your policy.

2. How can I ensure I am getting the best Auto Insurance Quote?

To ensure you obtain the best auto insurance quote, gather multiple quotes from different insurance providers, ensure coverage levels are comparable, ask about discounts, and review customer feedback regarding claims processes and service quality. This comprehensive approach maximizes your chances of securing the best rate for quality coverage.

3. What should I do if I find an auto insurance quote that seems too good to be true?

If you encounter an auto insurance quote that appears too good to be true, confirm the details of the policy, check for hidden exclusions, review customer feedback about the insurer, and ensure that the coverage levels meet your needs. Always verify the insurer's reputation and reliability before proceeding.